The Death of the Petrol Station

15th February 2019

The number of petrol stations in the UK has decreased dramatically in the last 40 years. Many of the small, independent forecourts, once commonplace on the roads of the UK, have now ceased trading or been swallowed up and amalgamated into larger entities.

In the 1990s there were 40,000 petrol stations in the UK. You may be surprised to learn that in 2018 that figure has plummeted to just 8,500!

Perhaps even more startling is that between 1970 and 2012 there was a 75% decrease in petrol station forecourts in the UK.

Once popular brands such as Burmah, Globe, and Major have all closed or merged with larger companies.

So what has led to the death of the petrol station forecourt in the UK?

It’s Tough Out There

Closures and mergers have resulted in fierce competition, with supermarkets such as Tesco and Morrison’s gaining a greater market share – around 46%.

Dealers who are normally independently-owned, and supplied under an agreement with an oil company now hold 38%, while company sites owned by oil companies control 16% (Energy Institute, 2018).

Such competition has led to independent forecourts struggling to compete within the industry sector.

Dominance from the supermarkets also presents a potentially worrying problem for drivers of combustion engine vehicles as Supermarket forecourts tend to keep smaller fuel reserves. As a result, if the available fuel supply were low at any given time, they would struggle to meet demand, causing a serious inconvenience to drivers.

Engine Sizes

Engine sizes generally ranged between 1.0 and 2.0 litres in 1990, whereas in 2017, most vehicles have engine sizes between 1.8 and 2.0 litres (Cox Automotive Retail Solutions Ltd, 2018).

One of the possible reasons for the significant reduction in petrol forecourts is the increase in the average fuel tank size. Such an increase means today there is no longer a need to refuel as often as there would have been in 1990.

Increased Efficiency

Another potential reason for the downfall of the petrol station forecourt is the increased efficiency of modern motor vehicles.

Cars are generally much more fuel efficient than their counterparts from the late ’80s and early ’90s. A case-study from Cox Automotive Retail Solutions shows the fuel economy improvements of three-litre engines (or higher).

As you can see in 1990 the combined MPG (Miles Per Gallon) average was between 10-40 miles, while in 2017 that average was between 15-70. (Cox Automotive Retail Solutions Ltd, 2018).

Not Enough Forecourts

Despite the death of the petrol forecourt, there are more cars on the road than ever before. So, we now have more vehicles that need filling up, but fewer petrol stations to do so.

In 2018, there were 38 million vehicles in the UK, with 99.5% of them having an internal combustion engine which required petrol or diesel (Retail Marketing Survey, 2018).

The Rise of Electric

Over the last few years, there has been a significant increase in the number of electric vehicles. Such growth has been spurred on, in part, by government initiatives to tackle air-pollution and crack down on vehicles which don’t meet the latest emissions standards.

The early concerns drivers faced with electric vehicles over; price, range-anxiety, and lack of charging infrastructure are quickly evaporating in the UK with EV technology and infrastructure improving at a supersonic pace.

With no need to fill up in traditional forecourts, the growth of the electric vehicle market is undoubtedly affecting the revenue of petrol stations throughout the UK.

You may now be wondering just how popular electric vehicles are in the UK. Well, in October 2018, there were more than 182,000 electric vehicles on the road in the UK, an increase of 178,500 since 2013 (Next Green Car, 2018).

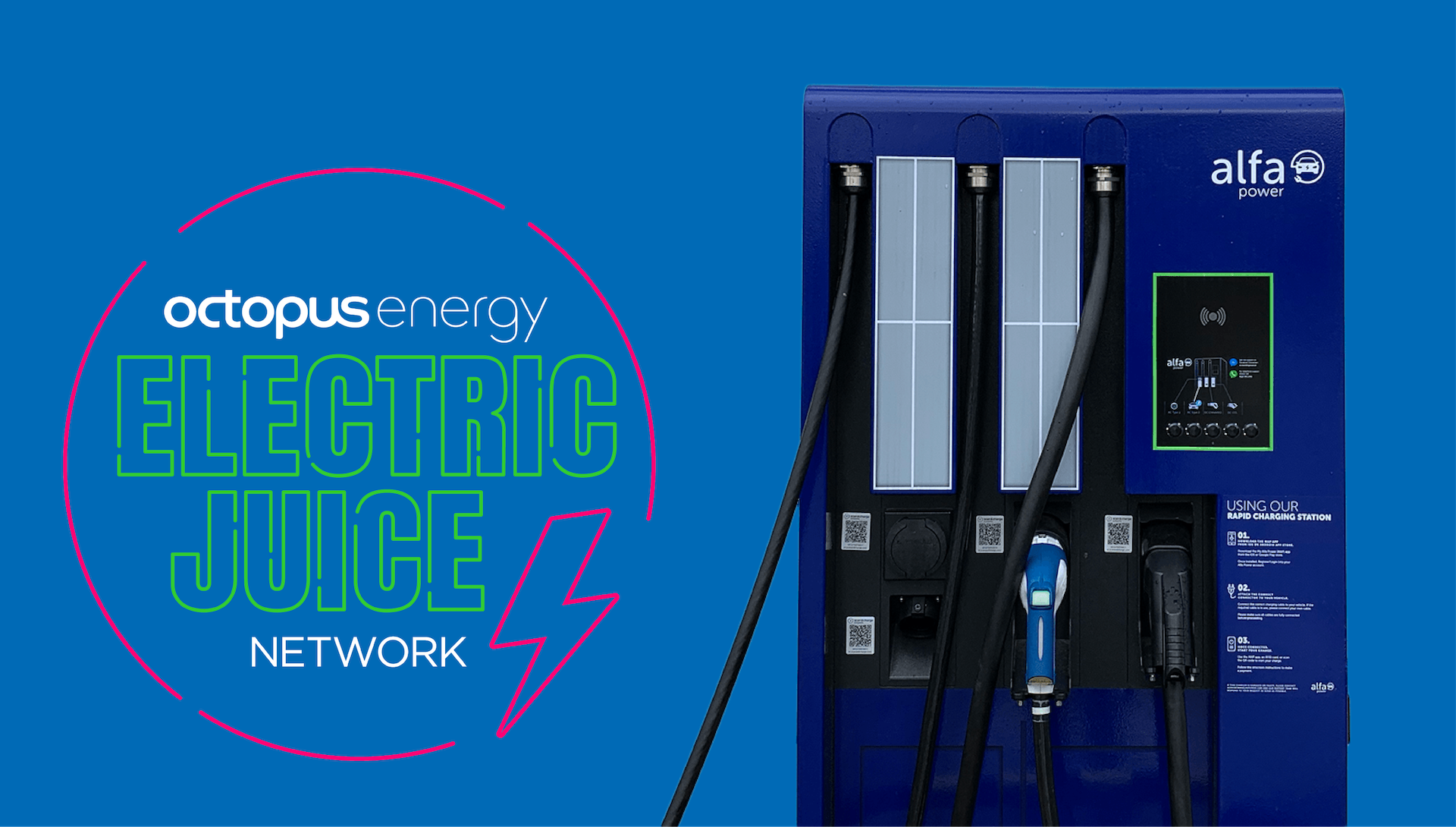

There were over 13,600 EV’s sold in the UK in 2017 alone and 10,000 motorists using public EV chargers (Zap-map, 2018).

The projected growth for electric vehicle (EV) sales in the UK estimates that 26 million EV’s will be on the road by 2050 (BBC, 2018).

Based on these numbers, the petrol station forecourt, in its current incarnation, finds itself in a most unenviable position.

Electric Taxis

Taxis will undoubtedly play a significant role in the growth of the EV industry in the UK, mainly due to the government’s clean air zone framework.

These clean air initiatives are being rolled out across the UK over the next few years with the government encouraging drivers to reduce emissions by creating zones only accessible (for free) by ultra-low emission vehicles in city centres throughout the UK.

Vehicles used as taxis, or by businesses, universities, and hospitals will all be encouraged to go electric in line with the latest initiative.

EV Tech

As the EV market continues to grow, companies in the industry will be forced to innovate in order to stand out; as a result, the end-user can expect improved efficiency, range, and standards in both vehicles and charging infrastructure.

Conclusion

Some of the statistics listed here certainly do not bode well for petrol stations. However, the figures suggest that if they can quickly and efficiently adapt to the EV trend, incorporating electrical charging points into their business model on a wider scale (as BP have done with Chargemaster) then there is certainly room for unprecedented growth alongside the electric vehicle.

More Recent News